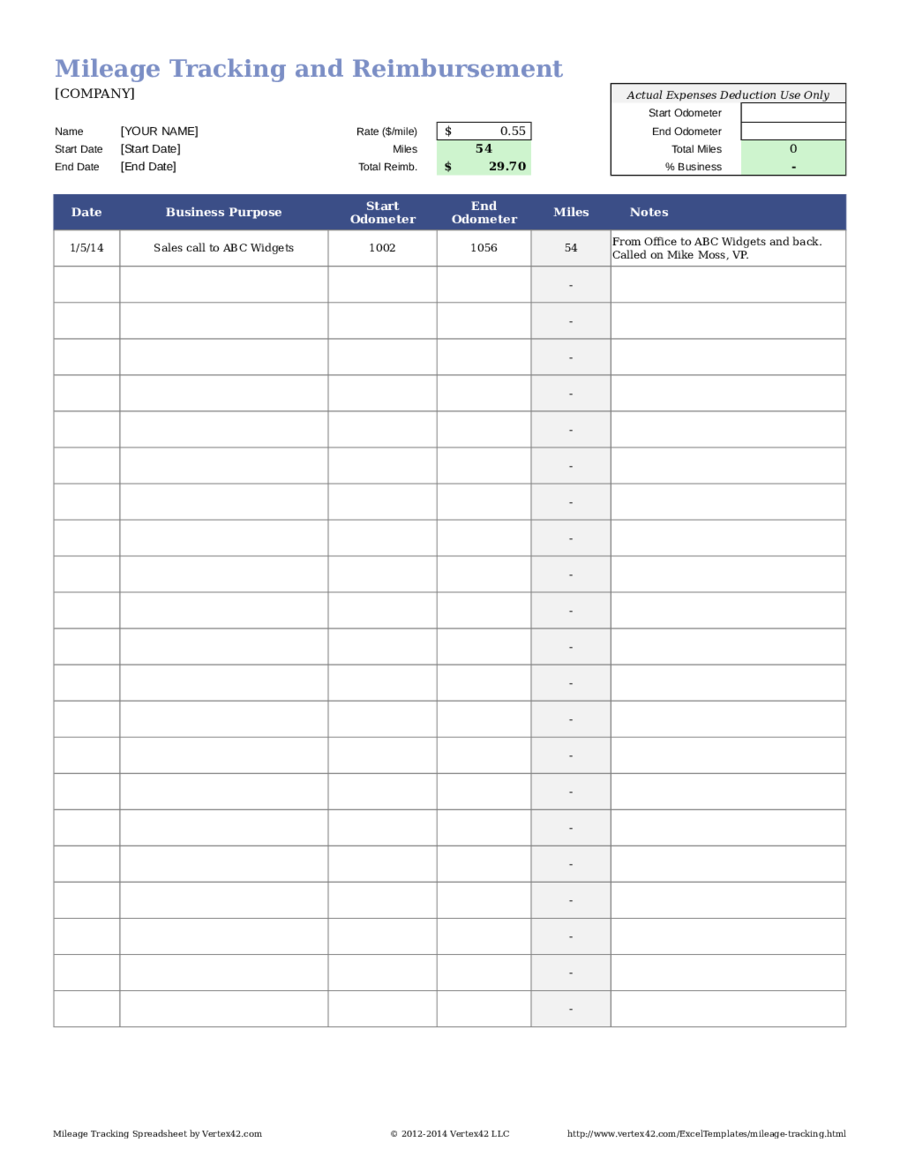

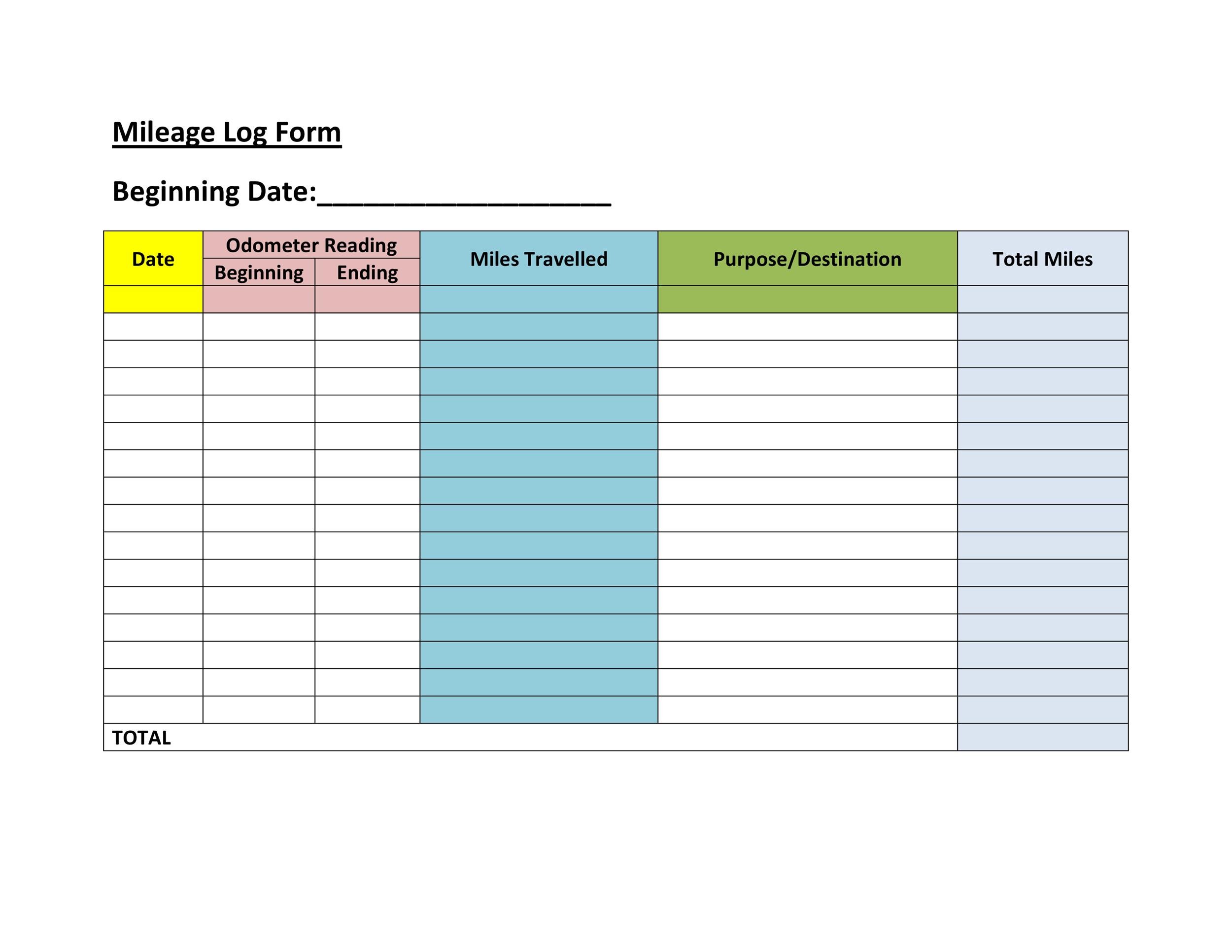

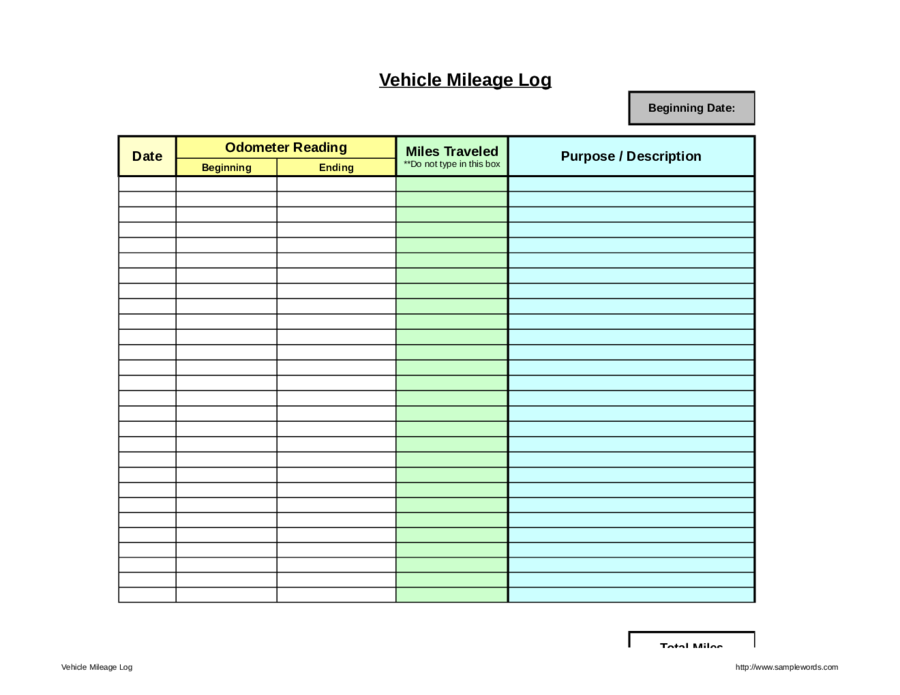

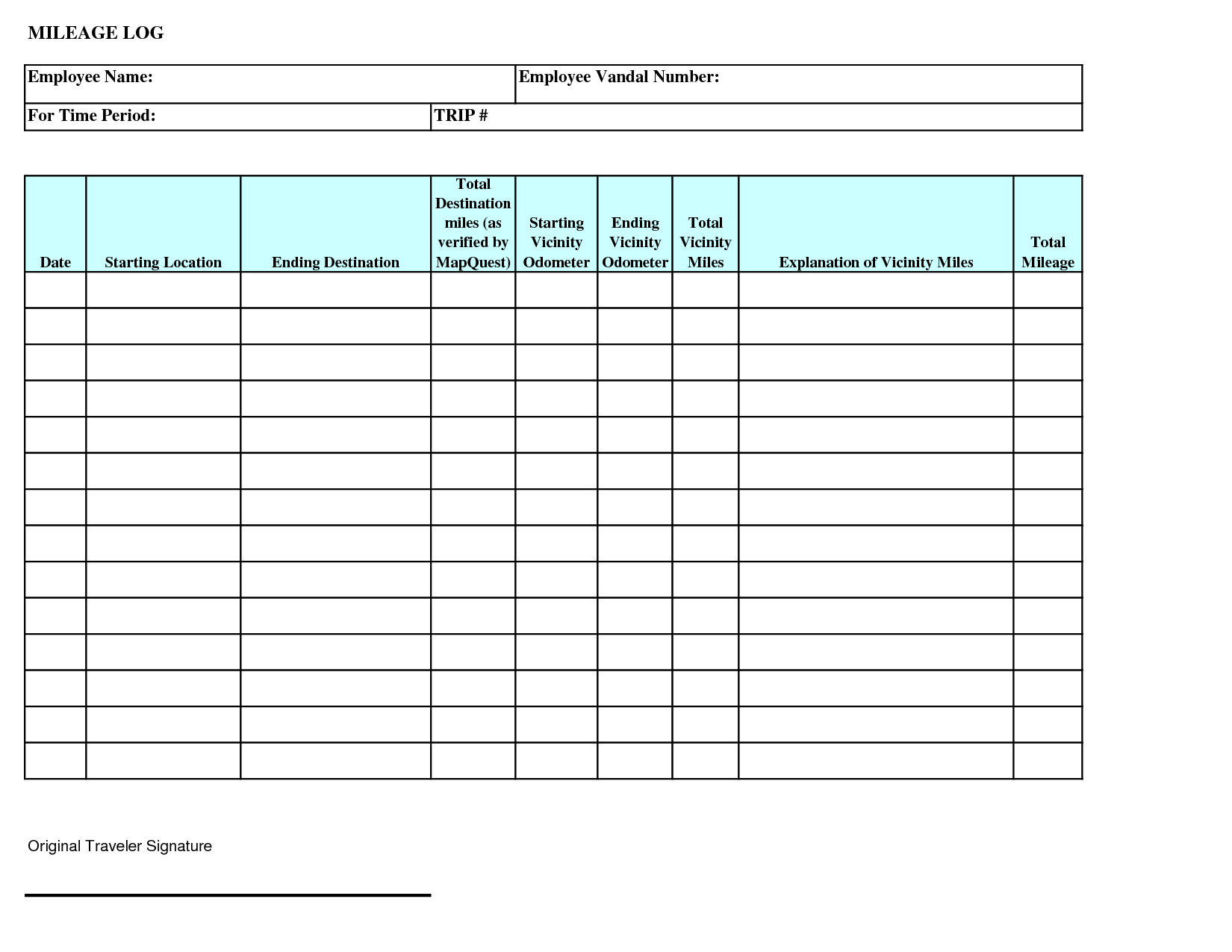

Free Mileage Log Forms. A well-maintained mileage log can make a huge difference for salespeople, service workers, or anyone who spends a significant time on the road for their job, especially if you are self-employed. To claim deductions on your tax returns, you have to keep meticulous records of your driving.

Next, enter the location you drove to and, of course, the mileage of that trip.

You should be recording your trips the same day, if possible, or every week at least.

This is important for business trips since Use the available log templates to keep extra printed copies. Mileage log form in purple blue and orange to track your miles driven related to your business. An accurate mileage log can make a big difference for anyone who spends a considerable amount of time driving their car for business purposes, such as rideshare or delivery drivers, salespeople, real estate agents, freelancers, service workers and many others, especially if they are self-employed.