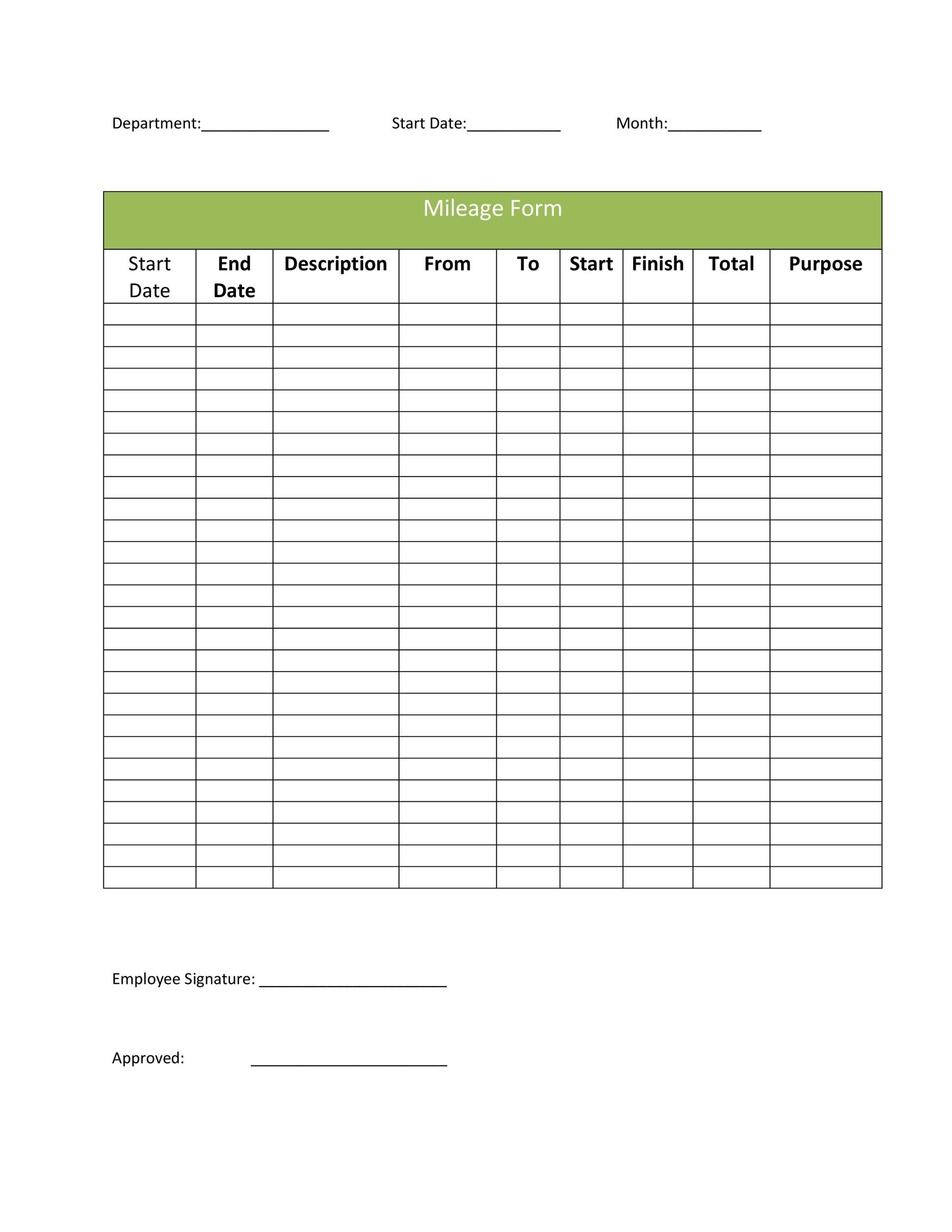

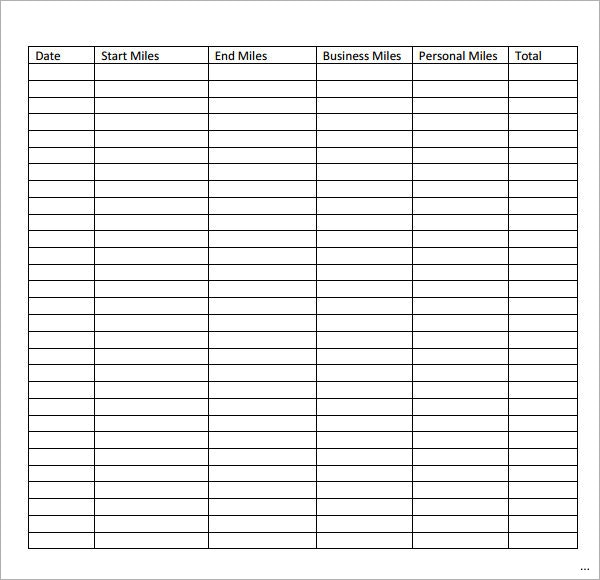

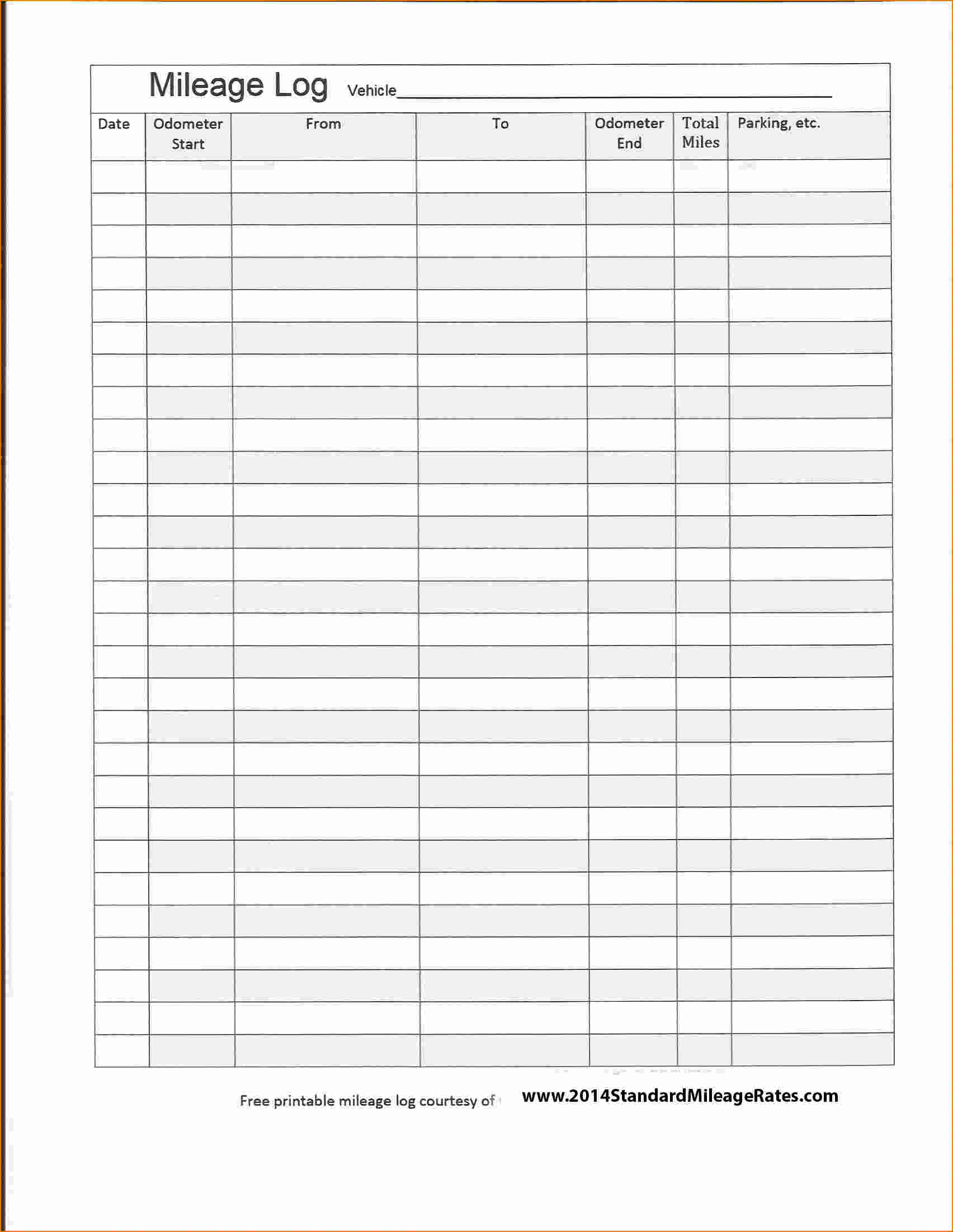

Free Mileage Log Form For Taxes. This figure is calculated by the standard mileage rate for the year to determine the dollar deductible. Mileage Reimbursement - Download a free Mileage Tracking Log for Excel to keep good mileage records and calculate business mileage for tax purposes.

It helps you to decide whether you should invest in a new car.

Your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending mileage at the conclusion of the year.

Mileage deducted for charitable purposes includes travel to You will only receive a federal tax benefit for charitable mileage if you itemize your deductions. To deduct this mileage from your taxes, you must keep careful records of the miles you drive each time you use your car for. One way of saving big money on your tax bill is by claiming back travel expenses, decidedly if you use your vehicle.